Easy Loans Ontario: Easy Accessibility to Financial Resources

Easy Loans Ontario: Easy Accessibility to Financial Resources

Blog Article

Navigate Your Financial Journey With Reputable Funding Providers Designed for Your Success

In the vast landscape of economic monitoring, the path to achieving your objectives can typically appear overwhelming and complicated. However, with the right guidance and assistance, browsing your financial trip can come to be a more successful and convenient endeavor. Trustworthy financing solutions tailored to fulfill your specific requirements can play a critical role in this process, using a structured technique to securing the necessary funds for your aspirations. By recognizing the details of different loan options, making informed choices during the application procedure, and efficiently handling repayments, individuals can take advantage of loans as calculated devices for reaching their financial landmarks. How exactly can these services be optimized to ensure lasting financial success?

Comprehending Your Financial Demands

Understanding your monetary needs is crucial for making informed decisions and accomplishing economic security. By taking the time to evaluate your economic scenario, you can recognize your short-term and long-lasting goals, create a budget, and create a strategy to reach economic success.

Furthermore, comprehending your economic needs involves identifying the distinction in between crucial expenditures and optional costs. Prioritizing your demands over wants can help you handle your funds better and stay clear of unneeded financial obligation. Furthermore, consider elements such as reserve, retired life planning, insurance coverage, and future financial objectives when examining your monetary needs.

Checking Out Loan Options

When considering your economic demands, it is crucial to explore different loan choices readily available to determine the most ideal service for your details scenarios. Recognizing the various kinds of car loans can help you make informed decisions that straighten with your financial goals.

One typical kind is a personal financing, which is unsafe and can be utilized for various objectives such as debt combination, home improvements, or unanticipated costs. Personal financings normally have repaired rate of interest and regular monthly settlements, making it less complicated to spending plan.

Another option is a protected car loan, where you give security such as a cars and truck or building. Safe lendings typically include lower rates of interest as a result of the decreased risk for the lending institution.

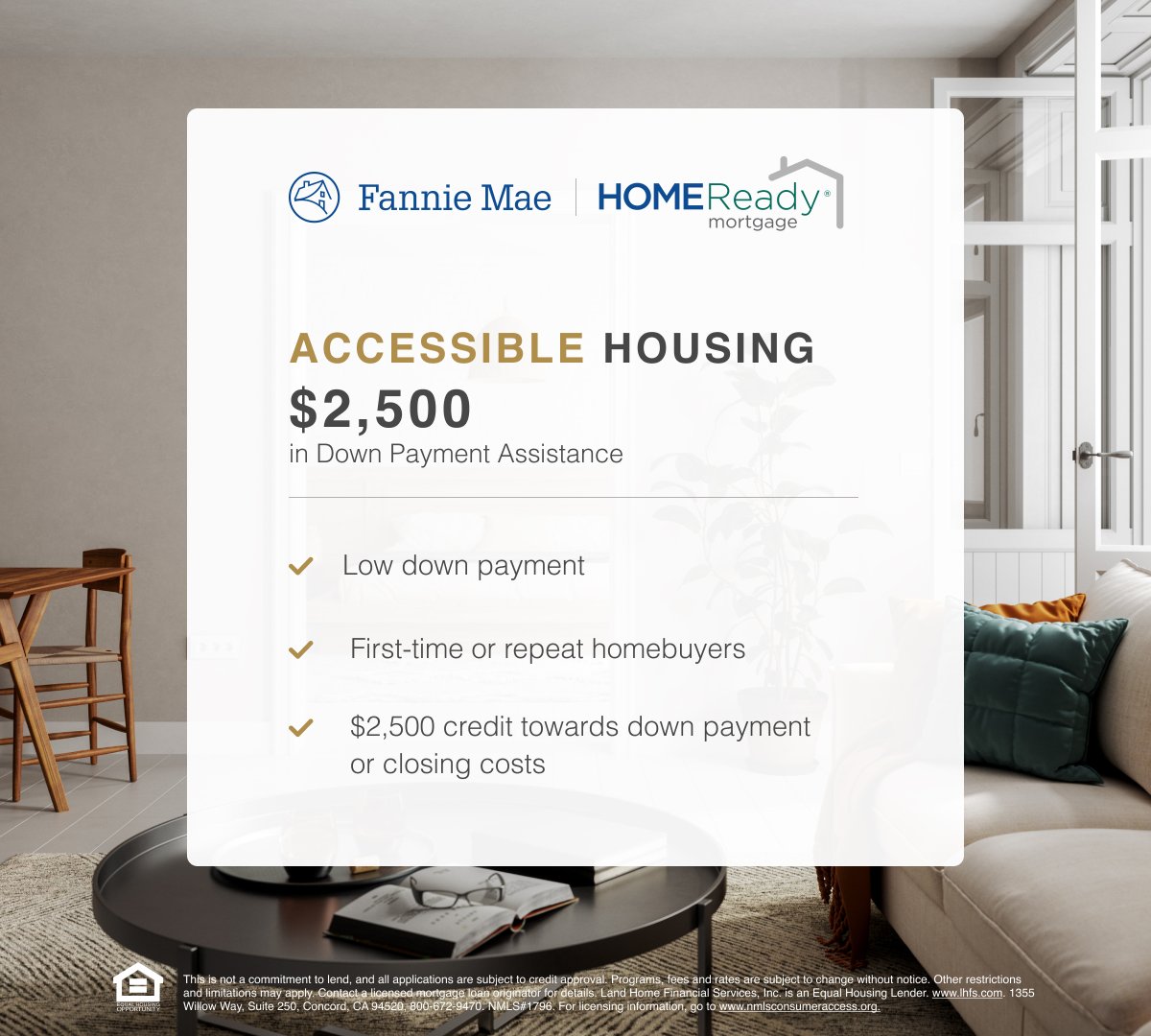

For those wanting to acquire a home, a home mortgage lending is a prominent option. Mortgages can differ in terms, rates of interest, and deposit needs, so it's critical to check out different lending institutions to find the most effective suitable for your circumstance.

Requesting the Right Financing

Navigating the process of using for a funding demands an extensive analysis of your monetary requirements and thorough research study into the offered options. Begin by examining the objective of the lending-- whether it is for a major acquisition, financial debt combination, emergency situations, or various other needs.

Once you've determined your economic demands, it's time webpage to discover the lending products provided by various loan providers. Contrast rates of interest, repayment terms, fees, and eligibility standards to locate the lending that best suits your requirements. Additionally, consider variables such as the lending institution's track record, client service quality, and online devices for handling your finance.

When requesting a finance, make certain that you supply total and precise information to expedite the authorization procedure. Be prepared to submit documents such as evidence of earnings, identification, and economic declarations as required. By carefully selecting the right loan and finishing the application carefully, you can set yourself up for financial success.

Taking Care Of Finance Payments

Effective monitoring of car loan payments is vital for maintaining monetary security and conference your obligations responsibly. By clearly identifying exactly how much you can allot towards funding settlements each month, you can ensure timely repayments and avoid any type of economic pressure.

Lots of financial institutions supply choices such as funding deferment, restructuring, or forbearance to assist consumers dealing with monetary obstacles. By actively handling your financing payments, you can keep monetary health and wellness and job in the direction of achieving your long-lasting economic goals.

Leveraging Car Loans for Economic Success

Leveraging fundings strategically can be an effective device in accomplishing financial success and reaching your long-lasting objectives. When used intelligently, car loans can give the needed resources to buy possibilities that may generate high returns, such as beginning a business, pursuing college, or buying property. loan ontario. By leveraging loans, people can read the article increase their wealth-building process, as long as they have a clear prepare for settlement and a comprehensive understanding of the dangers included

One key element of leveraging financings for financial success is to thoroughly examine the terms and problems of the financing. Comprehending the passion rates, repayment routine, and any type of associated fees is crucial to make sure that the loan aligns with your financial goals. In addition, it's necessary to borrow only what you require and can reasonably pay for to pay off to prevent falling under a financial obligation trap.

Final Thought

By recognizing the ins and outs of different financing choices, making informed choices throughout the application process, and successfully taking care of repayments, people can utilize lendings as calculated tools for reaching their economic turning points. loan ontario. By actively handling your loan settlements, you can preserve financial health and work towards achieving your lasting monetary goals

One trick element of leveraging fundings for monetary success is to very carefully evaluate the terms and problems of the loan.In verdict, recognizing your financial demands, discovering funding alternatives, using for my latest blog post the right car loan, managing car loan payments, and leveraging fundings for economic success are crucial actions in browsing your economic trip. It is crucial to thoroughly consider all facets of financings and monetary decisions to ensure lasting monetary security and success.

Report this page